If you’re using bank financing to buy any property, then you’re using a type of drug. As you know, some drugs can be therapeutic. While other drugs can kill you.

It doesn’t matter what type of property you buy. Whether you’re buying a single family home, apartment or commercial property, these principles are as relevant as the laws of gravity.

All real estate valuation boils down to financial analysis. Especially, when using debt.

There are four ingredients you must acknowledge before borrowing money to buy any property. If you measure these four mortgage loan ingredients thoughtfully, then your loan will act like a steroid—amplifying your wealth creation tremendously.

If you ignore mixing these four key ingredients properly, then you’re injecting your veins with the debt of heroin.

Before we reveal how to mix this drug’s (loan debt) ingredients properly, let’s first list them. Here they are:

- Loan constant (the secret ingredient)

- Rent potential (the denial ingredient)

- Positive leverage: spread between the loan constant and the cap rate (the common sense ingredient)

- Appreciation leverage: spread between the loan interest rate and the local market’s annual appreciation (the luck ingredient)

Note: the sum of positive leverage plus appreciation leverage is called combined leverage.

1—The Secret Ingredient…

What is the loan constant?

Answer—the loan constant (also known as a debt constant) represents the total yearly cash outflow payments on your loan. It’s represented as a %. The loan constant is not the APR.

Why is the loan constant important?

The reason why is because it tells you exactly what your hurdle rate is. Simply stated, would you borrow $100K at a 5%/year hurdle rate—to invest that $100K in something that would only pay you a 3.5% yearly dividend?

Of course not! Because you’d be losing money in this negative leverage scenario.

The only reason you would borrow at a 5% rate, to invest at the lesser 3.5% is: if you knew you could sell the property in the near future for much more money than you paid for it.

This is called speculating (more on that in a moment).

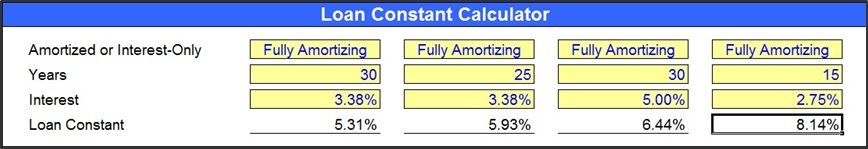

Therefore, when you’re comparing which mortgage loan is the safest loan to choose, you must compare the loan constant of each loan. Has your banker, mortgage broker or accountant ever informed you about a debt constant?

or is this the first time you’ve heard the word loan constant?

Here’s a real world example calculation. Notice the safest loan here is the 30-year mortgage. And the most risky loan is the 15-year mortgage.

In a sense, the loan constant is the secret ingredient because no one really knows about it—except successful hedge fund managers. The general public hasn’t heard about it. And the banker opening your checking account hasn’t either—let alone how it’s used.

In fact, I’ve attended mandatory real estate broker classes. On numerous occasions, I’ve asked highly paid mortgage and real estate brokers alike, if they know what a loan constant is? I have yet to meet a broker, who can confidently answer “yes”.

It’s not taught in school. And it’s certainly not taught in broker training.

Personally, I learned it many years ago from a successful fund manager.

2—The Denial Ingredient…

Now that you understand how the loan constant ingredient tastes, the next key ingredient to sniff-out is: the rent potential of a property.

Single-handedly, one of the most important ingredients when justifying the use of mortgage drugs is: knowing what rental price a property would fetch—if it was rented at the current market value.

You might be asking…

“….I’m planning to live in the property, why do I need to know the rent price?”

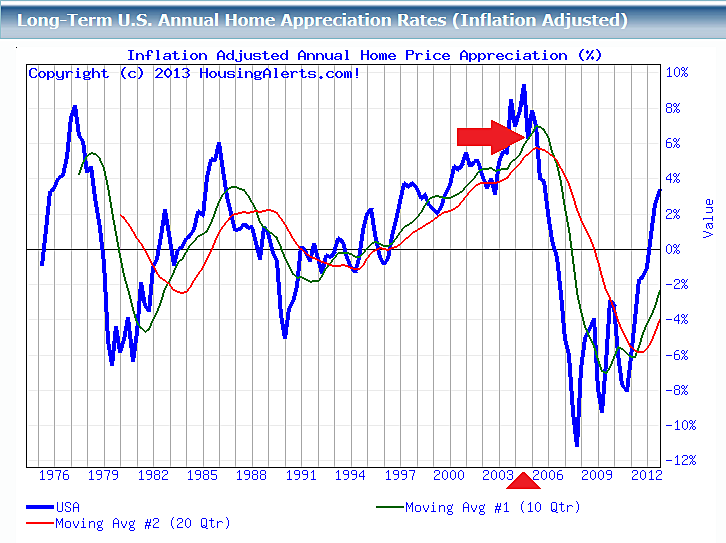

And here’s where the denial starts setting in. Mainstream America is brainwashed by their real estate brokers; on how the income potential of a property has little to do when buying residential real estate. And here’s a snapshot of what that denial led to.

In order to cross-check values in the next step of this risky recipe, you must verify the realistic rental rates for the subject property.

Repeat:

If you intend on buying or selling property, you must vet the likely rental price the property would capture, in the current market. Ask your real estate broker for this ingredient—it’s not rocket science to find.

In residential realtor classes, they falsely teach realtors to ignore the income approach when valuing real estate. Instead, real estate agents habitually rely on the sales comparison approach to value (otherwise known as “comps”).

This is why I call rent rates the denial ingredient. Because many in the residential real estate industry are in denial about it.

This is a huge mistake for the consumer—you.

Fortunately or unfortunately, all real estate is a matter of financial analysis. And the sales comparison approach alone falls way short on financial analysis.

How can you faithfully uncover property value when you ignore math?

Therefore, alongside the typical market analysis of recently closed sales, you must analyze a recent market analysis of rental rates. Yes, do it even if you intend on living in the property.

Confirming the market rent for the property is a critical second ingredient. It allows you to use simple kindergarten math. So you can calculate and compare the cap rates‚ as you’ll learn next.

But if you fail to check legitimate market rents, then don’t be surprised when you’re trapped inside a soon-to-pop market bubble. And even fatally overdose on your loan.

When you source this rental ingredient properly, you’ll be able to safely proceed and test the third ingredient.

3—The Common Sense Ingredient…

And how to create positive leverage.

The goal with positive leverage is to create a positive spread between the % Cap Rate and the Loan Constant.

Here’s how.

Realistically, there’s only so much yearly rental income a property can generate—assuming it was rented. Likewise, the property carries yearly expenses (like HOA dues and property taxes).

Once you know the yearly rental income, all you then do is subtract those yearly expenses (not including debt payments), from the yearly rental income. It’s basic math.

What’s left over is the Net Operating Income (NOI).

As an example, if you paid $100,000 for a property that collects $12,000 per year in rent…and has $8,000 in yearly expenses…then you have a Net Operating Income of $4,000.

This is common sense.

Therefore, if you divide the $4,000 per year Net Operating Income by the $100K value paid, then your yearly dividend (cap rate) is 4%.

This is more common sense. This is not rocket science.

If your property yields a “4 cap” while your loan’s debt constant is 3%, then congratulations, you’ve just created positive leverage in that scenario—because your total loan obligation is 1% less than your dividend yield. And that drug naturally acts like a steroid which will amplify your wealth.

What if in this (same!) example, however, you were to choose a drug which has a loan constant of 5% instead?

You guessed it…

You now have a negative leverage scenario.

If you were to choose a drug with a loan constant ingredient of 5% (when you’re net operating income yields a 4% cap rate), then you’ve just injected yourself with heroin.

What changed about the property?

Answer—nothing about the property changed.

The property in this example might actually be well-priced at fair market levels. The problem is you’re using heroin to buy it now. The natural laws supporting this property can’t be changed. The only thing that can be changed is your behavior.

Therefore, the proper maneuver would be to buy the property using all cash (no debt) under this second negative leverage scenario; or attempt to buy it at a lower price (if possible) so the loan financials fit its natural laws.

And here’s where the denial ingredient comes back into the scene.

Because the general public (and most real estate investors for that matter) buy property with limitless emotion; and they’ll ignore both the rent potential ingredient and the common sense positive leverage spread ingredient—simply because they want to own a property.

The ugly truth remains:

the majority of mortgage drugs are upside down loans at the time they’re signed for. And borrowers will resort to denial when they realize a property’s rent potential doesn’t justify the drug they’re using—simply because they want to own a property.

And now the story gets really good.

Because unless you plan to live in the property forever, then you’re simply speculating. If you intend to sell the property (and move into another property) in three years, five years or etc… then doesn’t it make sense to consider what the upward potential of its value will be?

Why would you risk your down-payment money—or more—to buy a property that has the projected upward potential of a lead anchor?

That is not common sense.

4—The Luck Ingredient…

What is appreciation leverage?

The goal with the appreciation leverage ingredient is to create equity via a positive spread between the interest rate (not the loan constant) and the expected annual appreciation.

Simply put, equity build-up through expected local market upside.

Don’t confuse the loan constant with the interest rate. Remember, interest rates have nothing to do with cash flow.

Note: similar to maximizing cash flow and equity build-up by creating a positive spread between the Cap Rate and the debt constant (positive leverage), the complementary goal of appreciation leverage is to create a positive spread between the mortgage loan’s interest rate and the expected local market appreciation.

Therefore, if you’re not intending on living in the property indefinitely, then you must compare the drug’s interest rate—to your local market’s annual appreciation.

Repeat: In this fourth (appreciation leverage) ingredient, we’re comparing the loan’s interest rate (not the loan constant) to the expected annual appreciation of property values (not rental income).

In plain English, if residential real estate in the local market is appreciating at 2% per year…and the drug’s interest rate is 3.38% per year…then in what year would the compounding effect of annual home price appreciation surpass the interest paid on your loan?

This “spread” is called appreciation leverage.

What’s the meaningful purpose of using drug financing (debt) in the first place?

Answer—to capture equity through leveraged financing!

It’s like a bodybuilder building muscle mass through the use of steroids. Would you inject yourself with steroids if you knew that you would build no extra muscle whatsoever—despite how hard you trained?

Of course not.

Why would you inject yourself with performance enhancing drugs if you knew the performance effects would be zero—and possibly negative?

Yet people do this everyday when obtaining mortgage loans. And, most often, under the guidance and direct supervision of a broker.

To strap on debt that is not accumulating equity is a huge risk.

In order to justify using drugs when buying a short-term investment or starter home, you would be wise to consider what wealth phase your local market cycle is in.

Is the local market appreciating or depreciating? And at what rate?

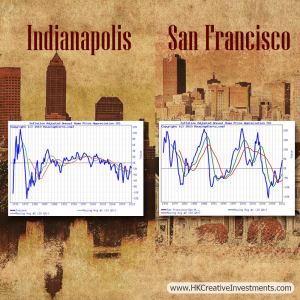

Is the property located in a high momentum cyclicality market (eg. San Francisco & Chicago)? Or is the property located in an equilibrium market like that of San Antonio?

Do you really believe that San Francisco, California—one of the hottest real estate markets in all of America—has the same magnitude of appreciation/depreciation as Indianapolis, Indiana?

Of course not. And here’s a 40-year chart comparison as living proof.

If you’re a first-time home buyer—and you’re planning on selling the property in a three-to-seven year period—then you must include an annual home price appreciation projection in your analysis.

If you or your advisor fail to do this, then the only reason your wallet won’t get chewed up in the meat-grinder will be by sheer luck; as you may have unwittingly bought at the start of another local wealth cycle.

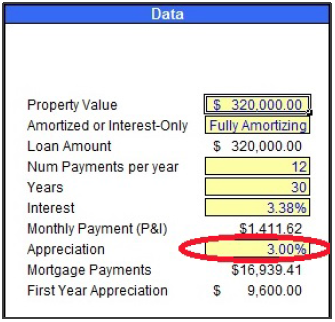

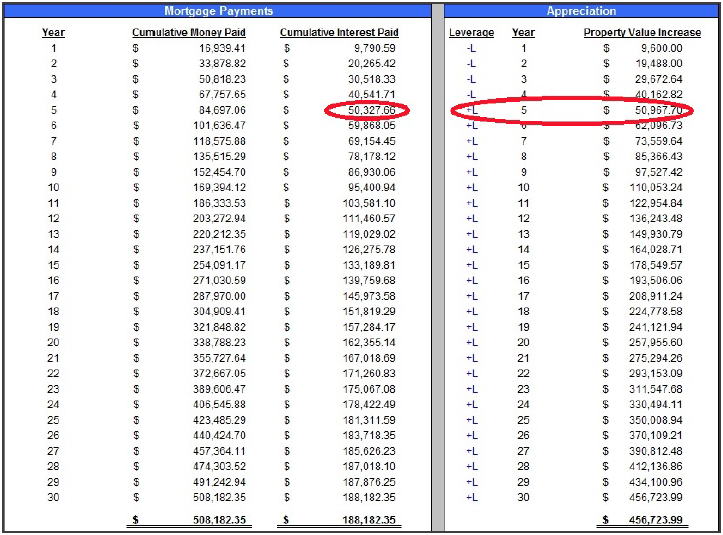

Here’s a real example of annual appreciation leverage projections alongside the mortgage drug’s interest rate:

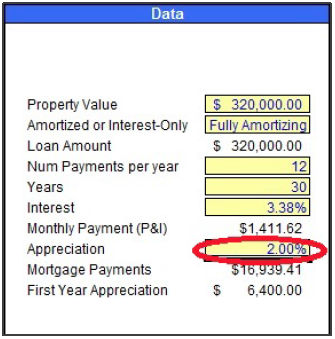

Let’s assume, the property in this example has a verified fair market property value of $320,000. And let’s assume the interest rate (at the time of this writing) for a fully amortizing 30-year mortgage is 3.38%.

Thus far, there is no guesswork with these two variables—they’re both tangible.

If you’re buying property with drug financing, and with the initial intention of living in it, for say 5 years, then you have to ask yourself:

“…at what rate is the local market expected to appreciate?”

Clearly, you wouldn’t buy the property today if you knew the local market would be lower in the 5th year when you intended to sell it.

Therefore, you must at least have a realistic upward projection.

Whether you decide to get this figure from your advisor, from the Wall Street Journal, or from your gut instinct—you must at least quantitatively acknowledge a potential trajectory for your local market.

Let’s firstly assume you predict a 3% annual home price appreciation.

If you witness the outcome of this first assumption in the calculator below, you’ll find that positive leverage kicks-in at year 5. When your property value will have increased by $50,967.70; while the cumulative interest paid on your drug is $50,327.66

If you initially had a 5-year exit strategy on this property, then you’d be injecting yourself with drugs (to capture equity upside)—but the drug’s therapeutic effects would be near zero. So now you have to deal with it’s side-effects instead.

Does that sound safe?

Does signing for a loan (pledging your and your co-signer’s assets and reputation) sound safe when your expected return for doing so is zero?

The property in this example might very-well be fairly priced. That’s a moot point if you buy it using heroin. And in flat or declining markets, these are the realities you must consider.

Note: if you read our real estate book, then you know that equilibrium and long-term secular downtrend markets have annual home price appreciation rates below 5%. Whereas, high momentum cyclical markets (eg. San Francisco), can have many times that amount.

Therefore, how can you expect to get the same output using a 3.38% loan in Indianapolis, Indiana as you would using that same drug in San Francisco, California?

Answer—you can’t.

And the proof is in the two cycle charts above. Mortgage drug rates are national; yet, each local real estate market in the U.S.A. has its own distinct DNA chart for appreciation/depreciation potential.

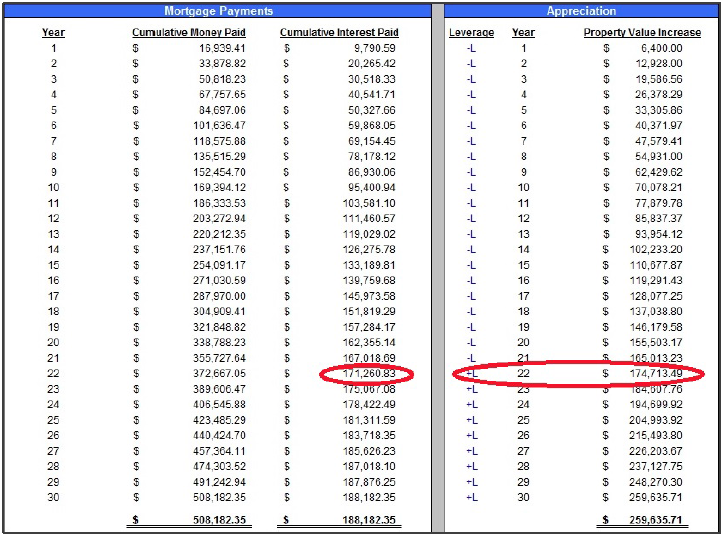

Witness what happens in this same example when you drop the annual home price appreciation to 2%. Instead of a 3% annual appreciation, assume 2% instead. Just by reducing the expected annual market appreciation by a measly 1%—causes 22 years before appreciation leverage kicks in.

In other words, at 2% annual appreciation, it would now take 22 years for a property value increase of $174,713.49 to surpass the cumulative interest paid of $171,260.83. Therefore, for the first 21 years, the borrower is using negative appreciation leverage. Talk about risky.

Do you really want to wait a quarter-of-a-century for appreciation leverage to kick in?

Does that sound like a recipe toward wealth creation?

Has your broker or banker ever advised you on how this fourth ingredient—appreciation leverage—affects your property buying decision?

Or are they simply handing you a larger needle so you can overdose?

Now you can see why appreciation leverage is the luck ingredient.

Because the vast majority of brokers and consumers don’t even measure it. Therefore, if you make money buying and selling your home—without measuring appreciation leverage—it shall be by sheer luck.

Notwithstanding the fact, you might have measured it—but the local market might not have moved as you predicted. Call that bad luck. Which is even more reason why you would be wise to consider the first three ingredients more heavily when you buy any property—because they’re less speculative in nature.

In summary, if you buy a property with drug financing…without safely tasting the first three ingredients…then the only reason you won’t overdose is if you get saved by the fourth ingredient (annual home appreciation).

Borrowing money to buy a property is a double-edged sword.

When you underwrite the opportunity thoughtfully, your loan can be a magic bullet. Remember that the same well-priced property can be a good deal when purchased all-cash; but a hidden land mine when purchased using drug financing.

FACT: In the year 2014, 28% of downtown Chicago condo sales were closed in CASH. Specifically, out of 5,254 total condo/townhome sales—1,467 were closed CASH. And 12% of those 1,467 CASH sales were in the $1mm+ price range. Amazingly, in Chicago’s premier 60611 zip-code, 43% of 2014 sales were all-cash. Source: HK Luxury Realty, Inc

As of this writing, 30% of all sales in the eleven most desirable downtown Chicago neighborhoods are now purchased with all-cash (no drug financing). Certainly, you can choose to buy as you see fit.

- If you’re an investor undertaking a fix-and-flip strategy, then loan interest rates and loan constants might matter a bit less because your cost of financing is budgeted into your construction costs. Assuming the market doesn’t go sideways (or reverse course completely) while you’re fixing it up—you should prevail.

- If you’re buying a property with the intention of living in it as a permanent home (for a considerable length of time) then deliberately buying with a negative leverage loan might not deter you—because you’re making this home a part of your daily lifestyle. And emotionally, you’ll get great enjoyment out of it—knowing it’s where you intend to lay your hat each day for decades.

The fact remains, when you buy property here at HK, we serve this information up to you on a silver platter—so you can make well-informed decisions. Knowing how to properly structure debt is the quickest way to create massive wealth (it’s easier said than done).

Get it wrong and lose big.

If you wish to Get Smarter Faster® when you buy Chicago luxury property, start your search and hire your expert broker.