It is common that after Congress enacts legislation, other authorities help to construe and interpret the specific language that Congress has used. With respect to tax legislation enacted by Congress, the Internal Revenue Service, often in the form of regulations or notices, plays a central role in explaining the wording approved by Congress.

One key provision in the tax legislation enacted by Congress on July 3, 2025 and signed into law by President Donald Trump on July 4, 2025 (the “2025 Tax Act”) concerns “qualified tips”. As provided by new Internal Revenue Code Section 224 in relevant part:

“There shall be allowed as a deduction an amount equal to the qualified tips received during the taxable year that are included on statements furnished to the individual pursuant to section 6041(d)(3), 6041A(e)(3), 6050W(f)(2), or 6051(a)(18), or reported by the taxpayer on Form 4137 (or successor). . . . The amount allowed as a deduction under this section for any taxable year shall not exceed $25,000. . . . The amount allowable as a deduction . . . shall be reduced (but not below zero) by $100 for each $1,000 by which the taxpayer’s modified adjusted gross income exceeds $150,000 ($300,000 in the case of a joint return). . . . The term ‘qualified tips’ means cash tips received by an individual in an occupation which customarily and regularly received tips on or before December 31, 2024, as provided by the Secretary. . . . No deduction shall be allowed under this section for any taxable year beginning after December 31, 2028.”

In recent months, the Internal Revenue Service has issued proposed regulations and a notice that clarify the “qualified tips” deduction under Code Section 224. This letter describes these proposed regulations and this notice.

List of Occupations Which Customarily & Regularly Received Tips

On September 19, 2025, the Internal Revenue Service issued proposed regulations under Code Section 224 (the “Code Section 224 Proposed Regulations”). Perhaps the key topic addressed by the Code Section 224 Proposed Regulations is the meaning of the phrase, “an occupation which customarily and regularly received tips on or before December 31, 2024”. Section 70201(h) of the 2025 Tax Act had provided, “Not later than 90 days after the date of the enactment of this Act, the Secretary of the Treasury (or the Secretary’s delegate) shall publish a list of occupations which customarily and regularly received tips on or before December 31, 2024, for purposes of section 224(d)(1)”.

Proposed Regulation Section 1.224-1(f)(1) states, “The occupations in Table 1 customarily and regularly received tips on or before December 31, 2024. Subject to the requirements in section 224 and this section, only qualified tips received in connection with the occupations listed in Table 1 are eligible for the deduction in section 224(a)”.

“Table 1” in the Code Section 224 Proposed Regulations lists the following 68 “occupations” as “Occupations that Customarily and Regularly Received Tips on or Before December 31, 2024”:

- “Bartenders”;

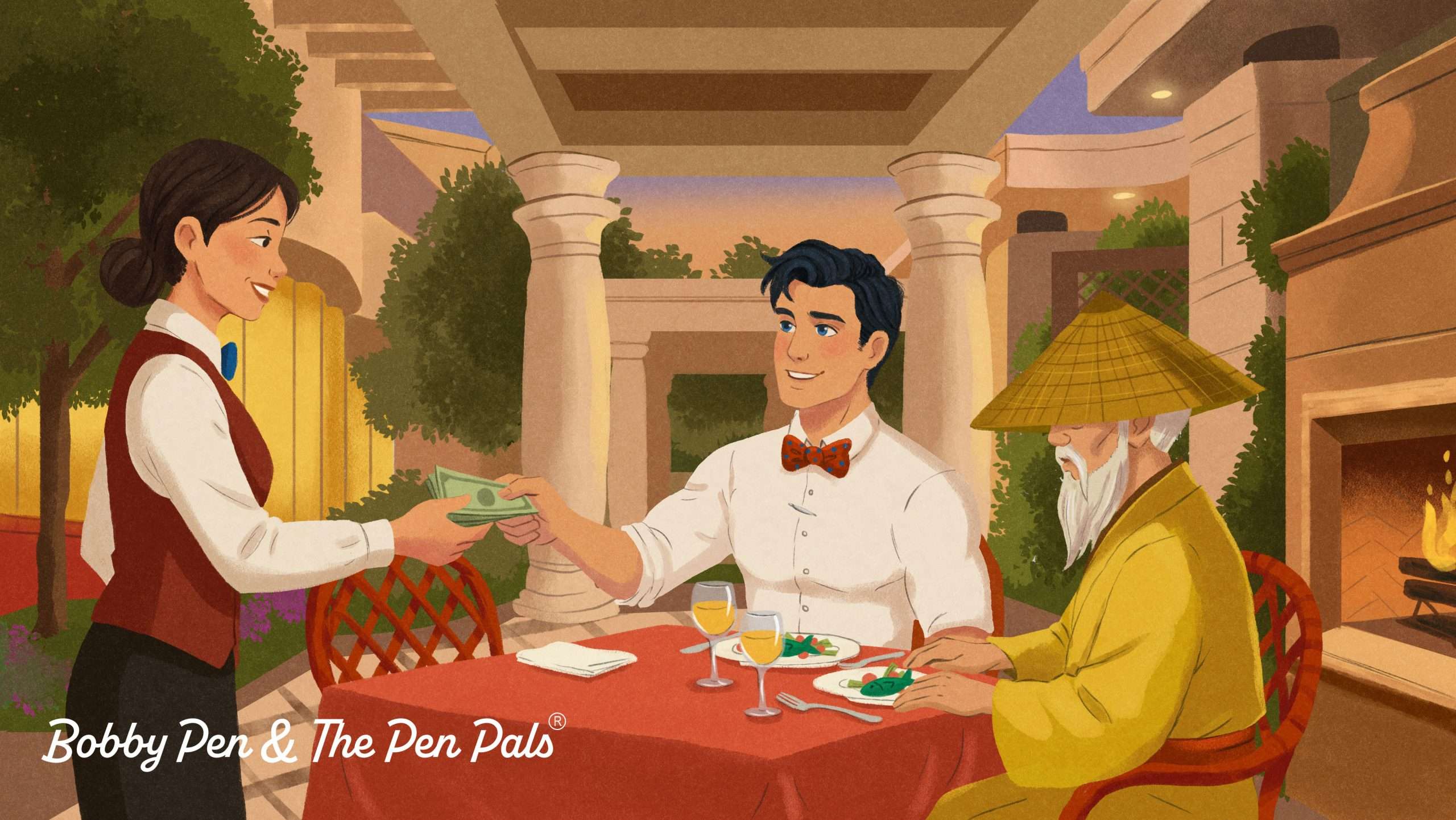

- “Wait Staff”;

- “Food Servers, Non-restaurant”;

- “Dining Room and Cafeteria Attendants and Bartender Helpers”;

- “Chefs and Cooks”;

- “Food Preparation Workers”;

- “Fast Food and Counter Workers”;

- “Dishwashers”;

- “Host Staff, Restaurant, Lounge, and Coffee Shop”;

- “Bakers”;

- “Gambling Dealers”;

- “Gambling Change Persons and Booth Cashiers”;

- “Gambling Cage Workers”;

- “Gambling and Sports Book Writers and Runners”;

- “Dancers”;

- “Musicians and Singers”;

- “Disc Jockeys, Except Radio”;

- “Entertainers and Performers”;

- “Digital Content Creators”;

- “Ushers, Lobby Attendants, and Ticket Takers”;

- “Locker Room, Coatroom, and Dressing Room Attendants”;

- “Baggage Porters and Bellhops”;

- “Concierges”;

- “Hotel, Motel, And Resort Desk Clerks”;

- “Maids and Housekeeping Cleaners”;

- “Home Maintenance and Repair Workers”;

- “Home Landscaping and Groundskeeping Workers”;

- “Home Electricians”;

- “Home Plumbers”;

- “Home Heating and Air Conditioning Mechanics and Installers”;

- “Home Appliance Installers and Repairers”;

- “Home Cleaning Service Workers”;

- “Locksmiths”;

- “Roadside Assistance Workers”;

- “Personal Care and Service Workers”;

- “Private Event Planners”;

- “Private Event and Portrait Photographers”;

- “Private Event Videographers”;

- “Event Officiants”;

- “Pet Caretakers”;

- “Tutors”;

- “Nannies and Babystters”;

- “Skincare Specialists”;

- “Massage Therapists”;

- “Barbers, Hairdressers, Hairstylists, and Cosmetologists”;

- “Shampooers”;

- “Manicurists and Pedicurists”;

- “Eyebrow Threading and Waxing Technicians”;

- “Makeup Artists”;

- “Exercise Trainers and Group Fitness Instructors”;

- “Tattoo Artists and Piercers”;

- “Tailors”;

- “Shoe and Leather Workers and Repairers”;

- “Golf Caddies”

- “Self-Enrichment Teachers”;

- “Recreational and Tour Pilots”;

- “Tour Guides”;

- “Travel Guides”;

- “Sports and Recreation Instructors”;

- “Parking and Valet Attendants”;

- “Taxi and Rideshare Drivers and Chauffeurs”;

- “Shuttle Drivers”;

- “Goods Delivery People”;

- “Personal Vehicle and Equipment Cleaners”;

- “Private and Charter Bus Drivers”;

- “Water Taxi Operators and Charter Boat Workers”;

- “Rickshaw, Pedicab, and Carriage Drivers”; and

- “Home Movers”

For each of these “occupations”, “Table 1” in the Code Section 224 Proposed Regulations includes an “Occupation Description” and “Illustrative Examples”. For the sake of brevity, I will not include here the “Occupation Description” and “Illustrative Examples” for each “occupation”, but as an example, with respect to the “occupation” of “Bartenders”, the “Occupation Description” is “Mix and serve drinks to patrons, directly or through waitstaff”, and the “Illustrative Examples” are “Barkeep, mixologist, taproom attendant, sommelier”.

In addition to interpreting the phrase, “an occupation which customarily and regularly received tips on or before December 31, 2024”, the Code Section 224 Proposed Regulations address other important issues, including (a) the definition of “cash tips” as “qualified tips” (“cash tips are tips received from customers or, in the case of an employee, through a mandatory or voluntary tip sharing arrangement, such as a tip pool, that are paid in a cash medium of exchange, including by cash, check, credit card, debit card, gift card, tangible or intangible tokens that are readily exchangeable for a fixed amount in cash (such as casino chips), and any other form of electronic settlement or mobile payment application that is denominated in cash. Cash tips do not include items paid in any medium other than cash, such as event tickets, meals, services, or other assets that are not exchangeable for a fixed amount in cash (such as most digital assets). . . .[T]ips are amounts paid by customers for services that are in excess of the amount agreed to, required, charged, or otherwise reasonably expected to have to be paid for the services in an arm’s-length transaction”), (b) the “voluntary” aspect of “qualified tips” (“Amounts are qualified tips only if they are paid voluntarily and without any consequence in the event of nonpayment, are not the subject of negotiation, and are determined by the payor. Qualified tips must be paid without compulsion. Thus, service charges, automatic gratuities and any other mandatory amounts automatically added to a customer’s bill by the vendor or establishment are not qualified tips, even if the amounts are subsequently distributed to employees. If a customer is expressly provided an option to disregard or modify amounts added to a bill, such amounts are not mandatory amounts”), (c) the application of Code Section 224(d)(2)(B) (which generally excludes from “qualified tips” amounts received when “the trade or business in the course of which the individual receives such amount is . . . a specified service trade or business (as defined in section 199A(d)(2)”), and (d) the exclusion of certain specific amounts received from “qualified tips” (including amounts received “for a service the performance of which is a felony or misdemeanor under applicable law”, “for prostitution services”, and “for pornographic activity”).

How To Determine The “Qualified Tips” Deduction

Besides the Code Section 224 Proposed Regulations, the Internal Revenue Service released further guidance concerning the “qualified tips” deduction under Code Section 224 when it issued Notice 2025-69 on November 21, 2025. Notice 2025-69 clarifies how to determine the “qualified tips” deduction in various “information-reporting” factual situations. Notice 2025-69 presents the following three “Examples”:

“Example 1. Employee A is a restaurant server. The amount reported in A’s Form W-2 box 7 is $18,000 of social security tips. A did not report any additional tips on Form 4137. A may use $18,000 in determining the amount of qualified tips for tax year 2025.

Example 2. Employee B is a bartender. During tax year 2025, B reports $20,000 in tips to B’s employer on Form 4070. B’s 2025 Form W-2 reports $200,000 in box 1, an amount in excess of the social security wage base, and $15,000 in box 7. Additionally, B reports $4,000 of unreported tips on Form 4137, line 4, and includes this amount in income on B’s Form 1040. B may use either the $15,000 in box 7 of the Form W-2, or the $20,000 of tips reported to B’s employer on Forms 4070 in determining the amount of qualified tips for tax year 2025. Regardless of the option chosen, B may also include the $4,000 of unreported tips from Form 4137, line 4, in determining the amount of qualified tips.

Example 3. Individual D is a self-employed travel guide who operates as a sole proprietor. In 2025, Individual D receives $7,000 in tips from customers paid through a third-party settlement organization as defined in section 6050W(b)(3). For tax year 2025, Individual D receives a Form 1099-K from an online booking platform that is a third-party settlement organization as defined in section 6050W(b)(3) showing $55,000 of total payments. The Form 1099-K does not separately identify the tips. However, Individual D keeps a log of each tour that shows the date, customer, and tip amount received. Because Individual D has daily tip logs substantiating the $7,000 tip amount, D may use the $7,000 tip amount in determining qualified tips for tax year 2025.”

These clarifying “Examples” in Notice 2025-69 concerning the issue of “information reporting” are especially important because the Internal Revenue Service has previously announced that it will not change Form W-2, Forms 1099, and other “payroll related” forms for taxable year 2025 to account for the “qualified tips” deduction.

The “qualified tips” deduction is often incorrectly described as a “no tax on tips” provision. The “no tax on tips” description is a misnomer because it does not constitute a direct exclusion of “tips” income from income taxation (instead it is a deduction), tips are still subject to Social Security and Medicare taxation, tips may still be subject to state taxation, and for any number of reasons (i.e., too much “tips” income, too much “modified adjusted gross income”, “post-year 2028 tips”, and failure to meet the specific requirements of Code Section 224), certain taxpayers who receive what are commonly referred to as “tips” may not be able to qualify under Code Section 224. However, for those taxpayers who receive tips and can qualify under Code Section 224, the Code Section 224 Proposed Regulations and Notice 2025-69 provide critical clarifications to help those taxpayers properly claim and benefit from the “qualified tips” deduction.

If you have any questions concerning the Code Section 224 Proposed Regulations or Notice 2025-69 with respect to the “qualified tips” deduction, or any other issue concerning the “qualified tips” deduction, please discuss these issues with your advisers.

Note – Notice 2025-69 and the “Qualified Overtime Compensation” Deduction

Notice 2025-69 does not only concern the “qualified tips” deduction under Code Section 224. It also addresses another deduction that became law under the 2025 Tax Act – the “qualified overtime compensation” deduction under Code Section 225. As described in Notice 2025-69, “In general, section 225 provides an income tax deduction for ‘qualified overtime compensation’, defined in section 225(c) as overtime compensation paid to an individual required under section 7 of the [Fair Labor Standards Act of 1938, as amended (‘FLSA’)] that is in excess of the regular rate at which the individual is employed”. Notice 2025-69 states, “Section 225(c)(1) defines ‘qualified overtime compensation’ as overtime compensation paid to an individual required under 29 USC § 207 that is in excess of the regular rate in which the individual is employed. The FLSA defines the regular rate as including ‘all remuneration for employment paid to, or on behalf of, the employee’, subject to eight exclusions established in 29 USC § 207(e). Part 778 of CFR title 29 contains the regulations addressing the calculation of the regular rate of pay for overtime compensation under 29 USC § 207. Individuals covered . . . by the FLSA generally must receive overtime pay for hours worked in excess of 40 in a workweek at a rate not less than one and one-half times their regular rate of pay. Generally, the amount of overtime pay due to an individual is based on the individual’s regular rate of pay . . . and the number of hours worked in a workweek. . . . Certain individuals are statutorily exempt from the FLSA’s overtime requirements. . . . The Code and the FLSA use different definitions of ‘employee.’ Therefore, it is possible (but not common) for a non-employee under the Code to be covered as an employee under the FLSA. Under the FLSA, the overtime requirements are different for certain classes of employers and employees (as defined in the FLSA) under specific circumstances. . . . Some employers or other service-recipients, on their own initiative, under a collective bargaining agreement with a labor union, and/or under State law, may provide overtime pay that is not required by 29 USC § 207. . . . Section 225(c)(2) of the Code excludes from the definition of qualified overtime compensation any qualified tips as defined in section 224(d) of the Code”. As it provides critical guidance to understanding Code Section 225 (including six “Examples” that “illustrate how an individual may determine the amount of qualified overtime compensation that may be allowed as an income tax deduction under section 225 of the Code for tax year 2025”), Notice 2025-69 should be reviewed by any taxpayer seeking to claim the “qualified overtime compensation” deduction.

If you have any questions concerning Notice 2025-69 with respect to the “qualified overtime compensation” deduction, or any other issue concerning the “qualified overtime compensation” deduction, please discuss these issues with your advisers.

If you wish to discuss any of the above, find Pen Pal Gary’s contact info here.

Disclaimer: please note that nothing in this article is intended to be, or should be relied on as, legal advice of any kind. Neither LHBR Consulting, LLC nor Gary Stern provides legal services of any kind.

HK® | Bobby Pen & The Pen Pals® | All rights reserved.